EOG Resources' Q3 2025 Earnings: Previewing Results Amid Volatile Oil Markets

- Marketing Admin

- Nov 8

- 4 min read

Research indicates #EOG Resources' Q3 2025 earnings, set for release after market close on November 6, 2025, with a conference call on November 7, are expected to show adjusted EPS around $2.43-$2.44, reflecting challenges from lower oil prices but supported by production growth and efficiency gains. While a beat could boost sector sentiment, potential misses due to volatility may highlight shale vulnerabilities.

Key Highlights

Earnings Details: Results after close on November 6, 2025; conference call at 9 a.m. CT (10 a.m. ET) on November 7.

Financial Expectations: Consensus EPS of ~$2.43 (down YoY), revenue ~$5.5B-$6B.

Operational Focus: Emphasis on shale efficiency, with Q3 production guidance showing ~3% sequential growth, driven by Utica expansion.

Market Implications: As a U.S. shale bellwether, outcomes could influence energy stocks amid WTI volatility around $60-$65.

Risks and Opportunities: Hedging strategies provided some cushion, but tariffs and supply builds pose risks in a shifting energy landscape.

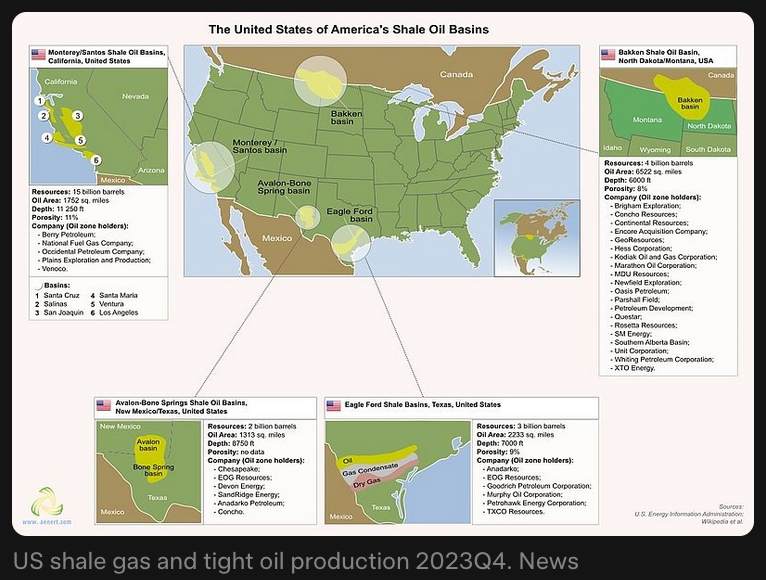

What is EOG Resources? EOG Resources, a major independent oil and gas producer, focuses on high-return U.S. shale plays like the Permian Basin and Eagle Ford, with recent expansion into Utica.

Why This Earnings Report Matters With global oil demand moderating and alternative energy shifts accelerating, EOG's results will signal resilience in U.S. shale production.

Potential Economic Ripple Effects Strong performance may rally energy ETFs; setbacks could pressure the sector, especially with API inventory data showing builds. For more, visit EOG Investor Relations.

EOG Resources, Inc. (NYSE: EOG), headquartered in Houston, Texas, is one of the largest independent exploration and production companies in the U.S., with a market capitalization exceeding $70 billion. Founded as Enron Oil & Gas in 1985 and spun off in 1999, EOG focuses on crude oil, natural gas liquids (NGLs), and natural gas production, primarily in key U.S. basins including the Permian, Eagle Ford, and recently expanded Utica shale via the $5.6 billion Encino acquisition. At the end of 2024, the company reported net proven reserves of 4.7 billion barrels of oil equivalent, emphasizing low-cost, high-return operations.

Under CEO Ezra Y. Yacob, EOG has prioritized operational efficiency and shareholder returns, generating significant free cash flow even in fluctuating markets. In Q2 2025, EOG reported revenue of $5.48 billion and net income of $1.35 billion ($2.46 EPS), beating estimates and returning $1.1 billion to shareholders through dividends and buybacks. This performance updated full-year 2025 guidance, projecting $4.3 billion in free cash flow at $65 WTI and $3.50 Henry Hub prices.

#Technical Specifications and Features

EOG stands out for its focus on premium drilling locations and technological innovations in shale extraction, enabling lower breakeven costs compared to peers. The company's multi-basin portfolio allows flexibility in response to commodity prices, with emphasis on sustainable practices amid energy transition pressures.

Metric | Q3 2025 Guidance/Estimate | Q2 2025 Actual | Q3 2024 Actual | YoY Change Estimate |

Adjusted EPS | $2.43-$2.44 | $2.46 | $3.16 | -23% |

Revenue | $5.5B-$6B | $5.48B | ~$6B | -8% |

Crude Oil & Condensate (MBod) | 529.9-534.9 | ~520 | ~500 | +6% |

NGLs (MBbld) | 297.5-312.5 | ~290 | ~280 | +7% |

Natural Gas (MMcfd) | 2,675-2,795 | ~2,600 | ~2,500 | +8% |

Total Equivalent (MBoed) | 1,273-1,313 | 1,240 | 1,200 | +6% |

Free Cash Flow | Part of $4.3B FY | ~$1B | ~$1.2B | -17% |

The Q3 2025 Earnings Preview: Production and Efficiency in Focus

EOG's Q3 report will highlight shale efficiency gains, with production guidance indicating a 3% sequential increase, bolstered by the Utica expansion. Analysts project EPS of $2.43, down 15.9% YoY, amid softer commodity prices, but revenue could hold steady around $5.5 billion. The conference call, hosted by CEO Ezra Yacob, will likely address hedging, cost controls, and updates to FY 2025 guidance of $11.79 EPS.

Competition with Peers and Broader Industry Dynamics

EOG competes with firms like Occidental Petroleum (OXY) and ConocoPhillips (COP) in U.S. shale, where it leads in low-cost production. Peers like Canadian Natural Resources and Diamondback Energy show mixed revenue growth, with EOG ranking lower recently (-11.18% in Q2) but strong in margins (61.7%). Global pressures, including tariffs on equipment and contracting manufacturing, could impact costs, while API data shows oil inventory builds adding downward price pressure.

Market-Moving Potential and Investment Surge

A beat, potentially 4% above consensus on EBITDA, could rally EOG shares (down ~11% YTD) and energy stocks, given its bellwether status. Analyst consensus is Neutral, with a $139 average price target (27% upside). This occurs amid surging energy investments, though alt-energy shifts and volatility underscore sector risks.

Looking Ahead: Challenges and Opportunities

While EOG's efficiency positions it well, challenges like price volatility and regulatory shifts persist. Success in Q3 could reinforce its role in the $1.5 trillion energy market, driving innovation in shale and beyond.

EOG Poised to Report Q3 Earnings: Here's What You Need to Know

EOG Resources (EOG) Earnings Date and Reports 2025 - MarketBeat

EOG Poised to Report Q3 Earnings: Here's What You Need to Know

EOG Resources Inc Earnings - Analysis & Highlights for Q3 2025

EOG Resources (EOG) Earnings Dates, Call Summary & Reports - TipRanks.com

EOG Resources (EOG) Projected to Post Earnings on Thursday - Ticker Report

EOG Resources reports $27 million in derivative settlements for Q3 2025 By Investing.com

EOG Resources, Inc. (EOG) Stock Price, Quote, News & Analysis | Seeking Alpha

Exploring EOG Resources's Earnings Expectations - EOG Resources (NYSE:EOG) - Benzinga

Here's What to Expect From EOG Resources' Next Earnings Report | Nasdaq