Gold Price Surge 2025: Hits Three-Week High at Over $4,100 Amid Economic Uncertainty, Government Shutdown, and Fed December Rate Cut Expectations

- Marketing Admin

- Nov 16

- 4 min read

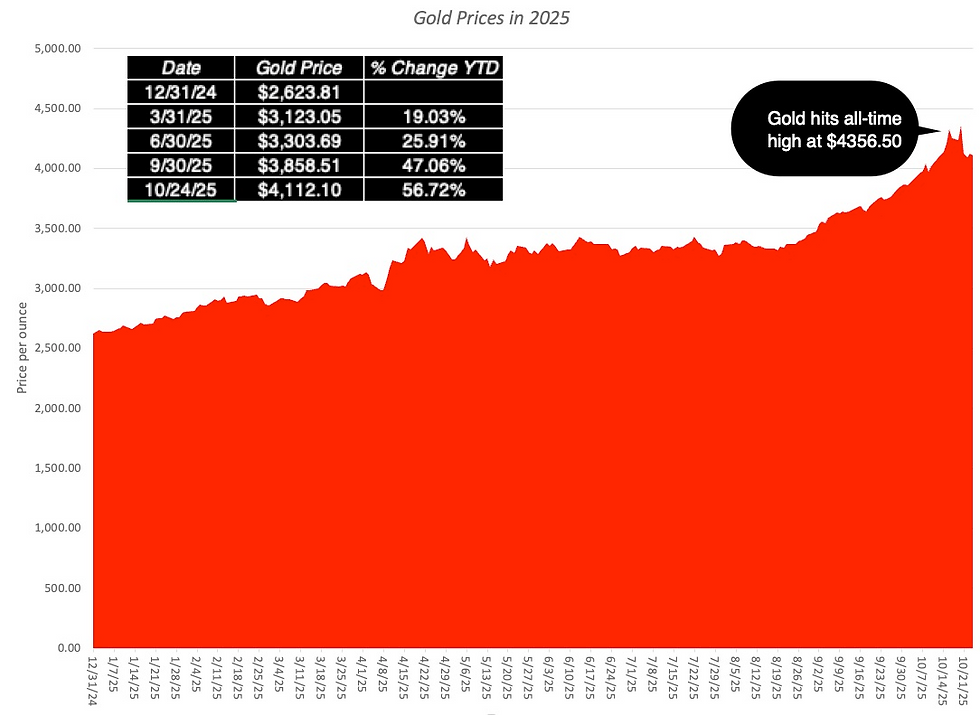

As economic uncertainty intensifies amid the prolonged U.S. government shutdown and weakening job data, gold prices have surged to a three-week high, reaching above $4,100 per ounce on November 11, 2025, marking a nearly 3% daily gain and contributing to a 57% year-to-date rally. Investors are flocking to precious metals as safe-haven assets, fueled by expectations of a Federal Reserve rate cut in December to combat potential tariff-driven inflation. This rally underscores broader market volatility, with analysts warning of spillovers to tech stocks, such as Nvidia, dropping nearly 3% to $193 amid supply chain fears from proposed 15-20% tariff hikes on imported components.

Precious Metals Rally: Gold and Silver as Safe Havens Amid Shutdown Fog

Gold futures climbed to $4,155 per ounce, recovering from recent lows and posting a 5% weekly gain amid the economic drag from the 45-day government shutdown. Silver also soared to $53 per ounce, reflecting a broader precious metals rally as investors seek protection from uncertainty. The shutdown has led to flight cancellations, lost wages, and stalled data releases, clouding economic outlooks and boosting haven demand. Weakening job data further fuels this trend, with gold's 57% YTD surge outpacing many assets.

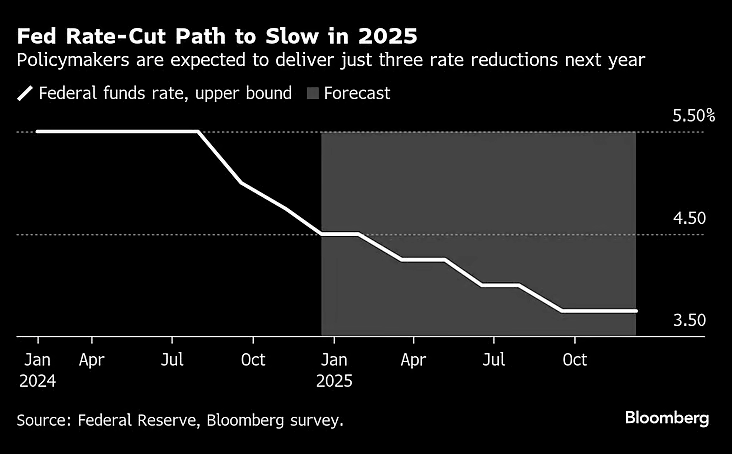

Fed Rate Cut Bets: December Probability at 65-70% to Counter Tariff Inflation

Market expectations for a December Fed rate cut stand at around 65-70%, as per CME FedWatch data, to offset potential inflation from Trump's tariff proposals. The Fed recently cut rates to 3.75-4%, signaling more easing in 2025 amid cooling employment. Tariffs could add 15-20% to import costs, stoking inflation and prompting monetary policy responses.

Broader Market Volatility: Tech Stocks Like Nvidia Face Supply Chain Fears

The gold surge highlights market jitters, with tech stocks bearing the brunt—Nvidia shares dropped 3% to $193 on November 11 amid tariff threats impacting components from China. The Nasdaq fell 3% last week, its worst since April's tariff announcements, as firms brace for higher costs. Analysts warn that 15-20% tariff hikes could disrupt supply chains, reducing investments in AI and semiconductors.

Outlook: Gold Forecasts to $4,500-$5,000 by 2026 Amid Persistent Risks

Experts forecast gold climbing to $4,500-$5,000 by end-2026, driven by ongoing uncertainties, though recent US-China tariff suspensions for a year could temper inflation. Despite this, spillover risks to tech persist, with X trends buzzing on economic fallout.

Gold price today, Tuesday, November 11, 2025 - Yahoo Finance - https://finance.yahoo.com/personal-finance/investing/article/gold-price-today-tuesday-november-11-2025-gold-moves-over-4100-continuing-this-weeks-rally-130014943.html

Gold Prices Are Rising Again. Why $5000 Could Be the Next Stop. - https://www.barrons.com/articles/gold-price-forecast-stock-miners-ad3dd3dd?gaa_at=eafs&gaa_n=AWEtsqegUEVKWia2n4GYyZtqVIihRiIDZFZDsvwBXFZ3xXRwRRJHP9HGpgZQ&gaa_ts=69156b57&gaa_sig=htpzSbwAeGmzhXwCPFF1U7ZBTJvpBCn292bEtyr278TLnktoVWDgWgdnoxlgpjJo2uMRuZXs-tgOs8A7tWaM1w%253D%253D

Gold climbs nearly 3% to two-week peak as soft economic data ... - https://www.reuters.com/world/india/gold-rises-more-than-1-fed-rate-cut-bets-slowdown-worries-2025-11-10/

Current price of gold: November 7, 2025 - Fortune - https://fortune.com/article/current-price-of-gold-11-07-2025/

A Golden Year (2025): Gold's Price Surge - The Signal in the Noise! - https://aswathdamodaran.blogspot.com/2025/11/a-golden-year-2025-golds-price-surge.html

Gold price prediction: Why are gold prices rallying again and what's ... - https://timesofindia.indiatimes.com/business/india-business/gold-price-prediction-today-where-are-gold-rates-headed-on-november-11-2025-and-in-the-near-term-mcx-gold-silver-prices/articleshow/125239089.cms

Gold Jumps, Silver Soars to $53 as US Fed Preps 'Ample' Liquidity ... - https://www.bullionvault.com/gold-news/gold-price-news/silver-gold-ratio-fed-liquidity-111220251

Gold price forecast: Gold rate to surge to $4700 in 2026? Here's ... - https://m.economictimes.com/news/international/us/gold-price-forecast-gold-rate-to-surge-to-4700-in-2026-heres-what-wells-fargos-gold-price-prediction-says/articleshow/125254045.cms

Fed to cut rates again in December on weakening job market, say ... - https://www.reuters.com/business/fed-cut-rates-again-december-weakening-job-market-say-most-economists-2025-11-12/

FedWatch - CME Group - https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The Fed Is Forecast to Cut Rates in December as Employment Cools - https://www.goldmansachs.com/insights/articles/the-fed-is-forecast-to-cut-rates-in-december-as-employment-cools

United States Fed Funds Interest Rate - Trading Economics - https://tradingeconomics.com/united-states/interest-rate

Will the Fed Cut Rates in December? Here's What Traders Think. - https://www.wsj.com/livecoverage/stock-market-today-dow-sp-500-nasdaq-11-12-2025/card/will-the-fed-cut-rates-in-december-here-s-what-traders-think--n9zOvkp24aIJtcAr5VR9?gaa_at=eafs&gaa_n=AWEtsqfqRrF1MMw3_P-9FVL3b6AV6kiCr9QoogAZX9Kv0G_uo8UeLRdecM0f&gaa_ts=69156b57&gaa_sig=OAu7pzonIWutTAbE7WFUuLXM98tlu1rT3gR31TLK2gu3aK_uKz9oT5cB9EcGdVMQqNKgFrsv32OEqlMOLW5K_w%253D%253D

The probability of a Fed rate cut in December is 64.1%, and ... - Bitget - https://www.bitget.com/news/detail/12560605056498

Federal Reserve's December Rate Cut Probability at 69.6% - Binance - https://www.binance.com/en/square/post/11-11-2025-federal-reserve-s-december-rate-cut-probability-at-69-6-32250580524657

What's The Fed's Next Move? | J.P. Morgan Research - https://www.jpmorgan.com/insights/global-research/economy/fed-rate-cuts

Fed Officials Split as Markets Price in December Rate Cut - https://news.bitcoin.com/fed-officials-split-as-markets-price-in-december-rate-cut/

NVIDIA Corporation (NVDA) Stock Historical Prices & Data - https://finance.yahoo.com/quote/NVDA/history/

Stock Info - Historical Price Lookup - NVIDIA Corporation - https://investor.nvidia.com/stock-info/historical-price-lookup/default.aspx

NVIDIA Stock Price History - Investing.com - https://www.investing.com/equities/nvidia-corp-historical-data

NVIDIA - 26 Year Stock Price History | NVDA - Macrotrends - https://www.macrotrends.net/stocks/charts/NVDA/nvidia/stock-price-history

NVIDIA Corporation Common Stock (NVDA) Historical Data | Nasdaq - https://www.nasdaq.com/market-activity/stocks/nvda/historical

NVDA Nov 2025 220.000 put (NVDA251121P00220000) - https://finance.yahoo.com/quote/NVDA251121P00220000/history/

NVIDIA (NVDA) Stock Price History From 1999 to Today - https://stockanalysis.com/stocks/nvda/history/

Nvidia | NVDA - Stock Price | Live Quote | Historical Chart - https://tradingeconomics.com/nvda:us

Top $NVDA Levels To Watch for November 10th, 2025 - YouTube - https://www.youtube.com/watch?v=e5te_XI3eEo

Tech stocks are having their worst week since the April tariff selloff ... - https://www.morningstar.com/news/marketwatch/20251107181/tech-stocks-are-having-their-worst-week-since-the-april-tariff-selloff-why-its-about-time

4 Ways the Trump Administration Could Impact Your Stock ... - Nasdaq - https://www.nasdaq.com/articles/4-ways-trump-administration-could-impact-your-stock-investments-next-3-years

US Tariffs: What's the Impact? | J.P. Morgan Global Research - https://www.jpmorgan.com/insights/global-research/current-events/us-tariffs

Yes, tech stocks have taken a hit. But the real danger lies elsewhere. - https://www.atlanticcouncil.org/blogs/econographics/yes-tech-stocks-have-taken-a-hit-but-the-real-danger-lies-elsewhere/

Markets News, Nov. 10, 2025: Stocks Surge on Optimism for Deal to ... - https://www.investopedia.com/dow-jones-today-11102025-11846476

Stocks Are in for an' Everything' Rally Through Year-End, Wells ... - https://www.businessinsider.com/stock-market-outlook-sp500-prediction-rally-shutdown-tax-earnings-tariffs-2025-11

Market Updates: November 12, 2025 - United States - UPS - https://www.ups.com/us/en/supplychain/resources/news-and-market-updates/market-update-november-12-2025

Most emerging nations can realign trade to weather US tariffs, report ... - https://www.reuters.com/world/china/most-emerging-nations-can-realign-trade-weather-us-tariffs-report-finds-2025-11-13/

Trump's $2,000 tariff dividend may be a smart political move ... - CNN - https://www.cnn.com/2025/11/11/business/trump-dividend-payment-tariff-stimulus

Trump puts China on notice with 155% tariff threat - is a November ... - https://m.economictimes.com/news/international/us/trump-puts-china-on-notice-with-155-tariff-threat-is-a-november-market-crash-coming/articleshow/124740282.cms