Retail Inventories Data and Investor Days 2025: Signaling Consumer Health Amid Tariff Pressures and Economic Fragility

- Marketing Admin

- Nov 18

- 4 min read

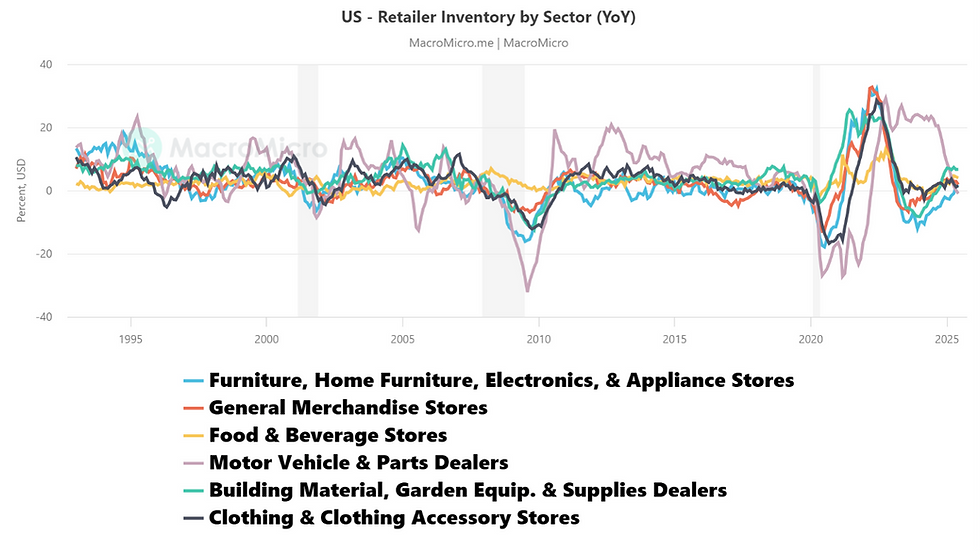

As investors eye indicators of consumer strength heading into the holiday season, September's Retail Inventories Ex Autos MoM data is set to release, with expectations of a +0.2% rise, offering insights into inventory builds amid preparations for peak demand. This metric is crucial as tariffs threaten to inflate prices for imported tech goods by 10-20%, potentially curbing spending and pressuring Q4 retail growth. Concurrently, National Vision Holdings' Investor Day in Duluth, GA, on November 17, will provide updates on eyewear tech and operations, likely addressing tariff impacts on supply chains. Datavault AI's pre-market investor update on the same day discusses quarterly performance, tying into data economy trends vulnerable to trade barriers. This combination highlights economic fragility, with X polls reflecting rising investor worries over jobs and inflation as top issues (17-18% citing them).

September Retail Inventories Ex Autos MoM: Expectations and Implications

The Retail Inventories Ex Autos MoM for September is forecasted at +0.2%, following August's 0.3% increase, signaling modest inventory accumulation as retailers gear up for holiday demand. Adjusted for inflation, this reflects cautious building amid economic headwinds, with tariffs poised to elevate costs for imported gadgets by 10-20%, potentially dampening consumer spending. Higher inventories could indicate softening demand if sales falter, pressuring Q4 retail growth projections.

National Vision Holdings Investor Day: Updates on Eyewear Tech and Supply Chains

National Vision Holdings (NASDAQ: EYE) hosts its Investor Day on November 17 in Duluth, GA, featuring presentations on eyewear technology, operational strategies, and financial outlooks. Executives will likely address tariff impacts on supply chains, given the company's reliance on imported frames and lenses, which could face 10-20% cost hikes. Recent Q3 results showed revenue growth and raised guidance, but investors seek clarity on navigating trade barriers.

Datavault AI Investor Update: Quarterly Performance in the Data Economy

Datavault AI Inc. (NASDAQ: DVLT) will deliver a pre-market investor update on November 17, covering Q3 2025 performance, revenue growth, and strategic partnerships. The discussion ties into broader data economy trends, vulnerable to trade barriers that could disrupt AI tokenization and RWA platforms. With 467% YoY revenue growth projected and 2026 targets at $40 million, tariffs pose risks to global expansion.

X Polls and Investor Sentiment: Rising Worries Over Jobs and Inflation

X polls and discussions reveal inflation and jobs as top concerns, with 17-18% of users citing them as primary issues in recent surveys. Posts highlight economic pessimism, with 57% viewing the economy as weak and inflation as a personal stressor for 48%. This underscores fragility, as tariffs amplify cost pressures on consumers and retailers alike.

In essence, these data points and events paint a picture of cautious consumer health, with tariffs looming as a key risk factor influencing Q4 outcomes and beyond.

United States Retail Inventories Ex Autos - https://tradingeconomics.com/united-states/retail-inventories-ex-autos

United States Retail Inventories Excluding Auto - https://www.investing.com/economic-calendar/retail-inventories-ex-auto-1887

Retail Sales ex Autos (MoM) - United States - 2025 Calendar Forecast - https://www.fxstreet.com/economic-calendar/event/27f14eda-e042-4f9c-8e96-1a94022eba00

US retail sales likely rose in September; higher-income consumers ... - https://www.reuters.com/business/retail-consumer/us-retail-sales-excluding-autos-likely-increased-again-september-chicago-fed-2025-10-15/

Monthly Retail Trade - Sales Report - https://www.census.gov/retail/sales.html

Market Commentary | September 22nd, 2025 - https://jjadvisor.com/market-commentary/market-commentary-september-22nd-2025/

United States Retail Sales Ex Autos MoM - https://tradingeconomics.com/united-states/retail-sales-ex-autos

September US Light Vehicle Inventory Rises 6% from August as ... - https://omdia.tech.informa.com/om138507/september-us-light-vehicle-inventory-rises-6-from-august-as-industry-heads-into-dicey-4q

U.S. Retail Retail Inventories Ex Auto Miss Expectations: Sector Rotation ... - https://www.ainvest.com/news/retail-inventories-auto-expectations-sector-rotation-opportunities-shifting-demand-landscape-2508/

National Vision Holdings, Inc. to Host Investor Day November 17, 2025 - https://ir.nationalvision.com/news-releases/news-release-details/national-vision-holdings-inc-host-investor-day-november-17-2025

National Vision Holdings, Inc. to Host Investor Day November 17, 2025 - https://www.businesswire.com/news/home/20251110753659/en/National-Vision-Holdings-Inc.-to-Host-Investor-Day-November-17-2025

National Vision Holdings, Inc. to Host Investor Day November 17, 2025 - https://www.nasdaq.com/press-release/national-vision-holdings-inc-host-investor-day-november-17-2025-2025-11-10

Investor Relations | National Vision, Inc. - https://ir.nationalvision.com/

News Releases - Investor Relations | National Vision, Inc. - https://ir.nationalvision.com/news-events/news-releases

National Vision: Home - https://www.nationalvision.com/

Investor Day 2025 | National Vision, Inc. - https://ir.nationalvision.com/events/event-details/investor-day-2025

National Vision Holdings, Inc. Announces Third Quarter 2025 ... - https://finance.yahoo.com/news/national-vision-holdings-inc-announces-120000588.html

National Vision Holdings, Inc. Reports Second Quarter 2025 ... - https://ir.nationalvision.com/news-releases/news-release-details/national-vision-holdings-inc-reports-second-quarter-2025

National Vision Reports 2025 Third Quarter Revenue Growth ... - https://www.visionmonday.com/eyecare/article/national-vision-reports-2025-third-quarter-revenue-growth-raises-full-year-guidance/

Datavault AI Inc. (NASDAQ: DVLT) Issues Investor Update ... - https://ir.datavaultsite.com/news-events/press-releases/detail/380/datavault-ai-inc-nasdaq-dvlt-issues-investor-update

Datavault AI Issues Investor Update Highlighting Continued ... - https://cioinfluence.com/machine-learning/datavault-ai-issues-investor-update-highlighting-continued-revenue-growth-strategic-partnerships-and-global-expansion/

Datavault AI Inc. (NASDAQ: DVLT) Issues Investor Update ... - https://futures.tradingcharts.com/news/futures/Web3MediaBreaks___Datavault_AI_Inc___NASDAQ__DVLT__Issues_Investor_Update_Highlighting_Accelerated_Revenue_Growth__Global_Partnerships__and_Platform_Expansion_470184337.html

Press Releases - Datavault AI Inc. (DVLT) - https://ir.datavaultsite.com/news-events/press-releases/detail/381/datavault-ai-inc-nasdaq-dvlt-announces-it-is-currently

Datavault AI Inc. (NASDAQ: DVLT) Issues Investor Update ... - https://www.barrons.com/press-release/datavault-ai-inc-nasdaq-dvlt-issues-investor-update-highlighting-continued-revenue-growth-strategic-partnerships-and-global-expansion-34f87783?mod=news_archive&gaa_at=eafs&gaa_n=AWEtsqdYnBY74L3hJ8t-VmNpp09LYZKVAqmLO0VCq41In0Iu3Imdg4mRGOP5&gaa_ts=69161899&gaa_sig=RABHFCzdBPuAA2s5OLJL21e_emMfTh3usR-84xA6_BI0Q2IzMYurDz85yXLWvmyzfWmzGEVbPdFACcVeL04TnA%253D%253D

Datavault AI Inc. (DVLT) - https://ir.datavaultsite.com/

Datavault AI's 314% Upside: Huge Potential or Wall Street Mirage? - https://www.marketbeat.com/originals/datavault-ais-314-upside-huge-potential-or-wall-street-mirage/

Datavault's Dream Bowl Draft Dividend Turns Proof Into Property - https://ir.datavaultsite.com/news-events/press-releases/detail/384/datavaults-dream-bowl-draft-dividend-turns-proof-into

$DVLT Datavault AI Inc. (NASDAQ: - BB's Stock Haven - https://investorshangout.com/post/view?id=6801417

X Post by HarrisX - https://x.com/HarrisXdata/status/1987916905970016738

X Post by Chris Mehl - https://x.com/ChrisMehl7/status/1983533083908599885

X Post by Greg Bluestein - https://x.com/bluestein/status/1983482962923700579

X Post by DC Cajun - https://x.com/DCCajun/status/1963931876474675549

X Post by Blue Virginia - https://x.com/bluevirginia/status/1958889869075177479

X Post by Artifex Fulminis - https://x.com/nealejw/status/1858881167082070383

X Post by Science X - https://x.com/scienceX07/status/1855908556060406264

X Post by America First Tracker - https://x.com/USAFirstTracker/status/1866692919173976186

X Post by StatCloud - https://x.com/StatisticCloud/status/1866645507562770809

X Post by OSZ - https://x.com/OpenSourceZone/status/1863950714080296973

X Post by Political Polls - https://x.com/PpollingNumbers/status/1863950274785628664

X Post by Jesse Ferguson - https://x.com/JesseFFerguson/status/1863945012016250957

X Post by Public News Service - https://x.com/PNS_News/status/1853482340829233328

X Post by Blueprint - https://x.com/BlueprintPolls/status/1848850597195211236

X Post by Christian Collins - https://x.com/CollinsforTX/status/1844890355529024004

X Post by UnidosUS - https://x.com/WeAreUnidosUS/status/1844123823056343300

X Post by Thomas J. Rachko, Jr. - https://x.com/ThomasJRachkoJr/status/1853912721730818066

X Post by MARIA TERESA KUMAR - https://x.com/MariaTeresa/status/1844123823056343300