S&P Flash U.S. PMI Releases: Manufacturing and Services Data as a Critical Economic Health Check

- Marketing Admin

- Nov 21

- 3 min read

Economists anticipate the Manufacturing PMI at around 48.5, indicating contraction below the 50 threshold, while the Services PMI is expected at approximately 54.8, signaling modest expansion. This release stands as the most critical, crucial, and hottest story dominating discussions, as PMIs often trigger immediate market swings—such as 1-2% volatility in the Nasdaq—and ignite endless debates on X and CNBC amid fears of a tariff-fueled manufacturing slump. Tariffs are projected to raise input costs for tech components like chips by 10-20%, potentially delaying AI and data center builds. Weak readings could elevate recession odds, with Q4 GDP forecasts at 1.8-2.2%, boost December Fed cut bets to 80% probability, and underscore tech sector fragility—setting the tone for holiday consumer trends and 2026 outlooks.

PMI Data Preview: Manufacturing Contraction vs. Services Expansion

The Flash Manufacturing PMI for November is forecast at ~48.5, down from October's 52.2, suggesting a potential contraction, as readings below 50 indicate declining activity. This reflects ongoing weakness, exacerbated by trade frictions, with new orders and production sub-indices likely to be pressured. In contrast, the Services PMI is expected to be ~54.8, up slightly from October's 55.2, suggesting continued, though modest, growth in the dominant services sector. These PMIs, based on surveys of purchasing managers, provide early signals ahead of official GDP data, making them essential for gauging economic health.

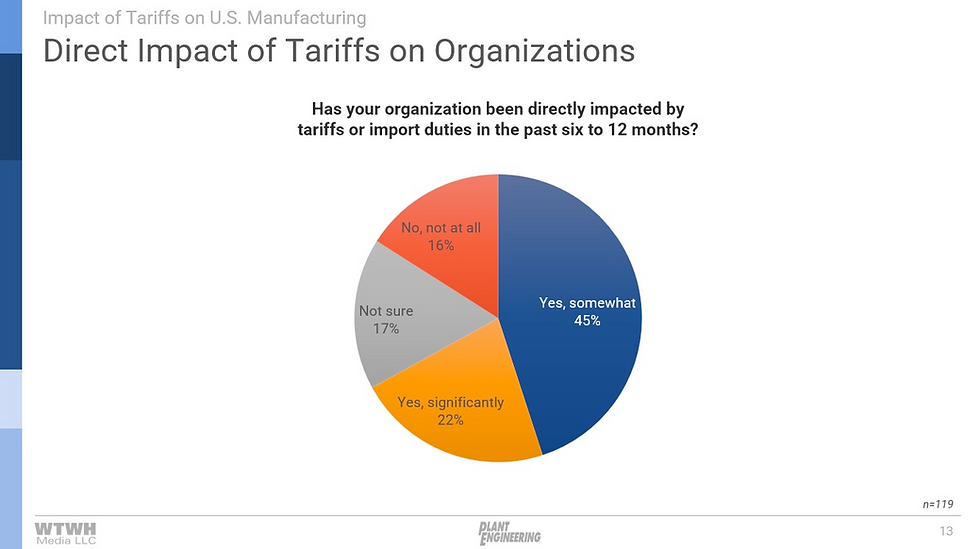

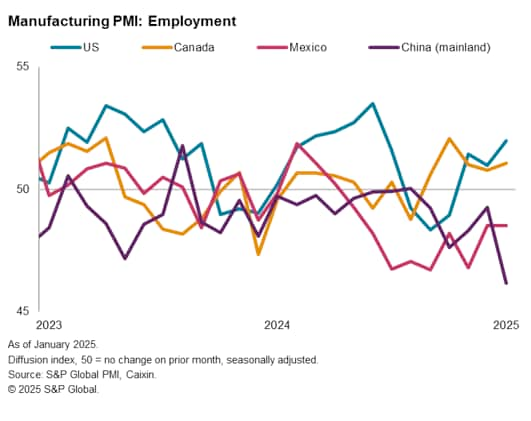

Tariff-Driven Manufacturing Slump: 10-20% Input Cost Increases

Tariffs are a central concern, blamed for diminishing demand and raising input costs by 10-20% for tech components like semiconductors, potentially delaying AI infrastructure and data center expansions. Recent PMI data shows manufacturers stockpiling to mitigate hikes, but this poses downside risks to future production. The ISM Manufacturing PMI fell to 48.7 in October, underscoring contraction amid trade uncertainties. If November's flash confirms this trend, it could signal broader manufacturing woes, affecting the supply chains of tech giants.

Market Swings and Debates: Nasdaq Volatility and Recession Odds

PMIs frequently cause immediate market reactions, with surprises leading to 1-2% swings in the Nasdaq as investors reassess growth prospects. Weak data could heighten recession fears, pushing Q4 GDP forecasts toward 1.8-2.2% and elevating the probability of a December Fed cut to 80%. On X and CNBC, expect fervent debates over tariff implications, with analysts highlighting the fragility of tech sectors reliant on imported inputs.

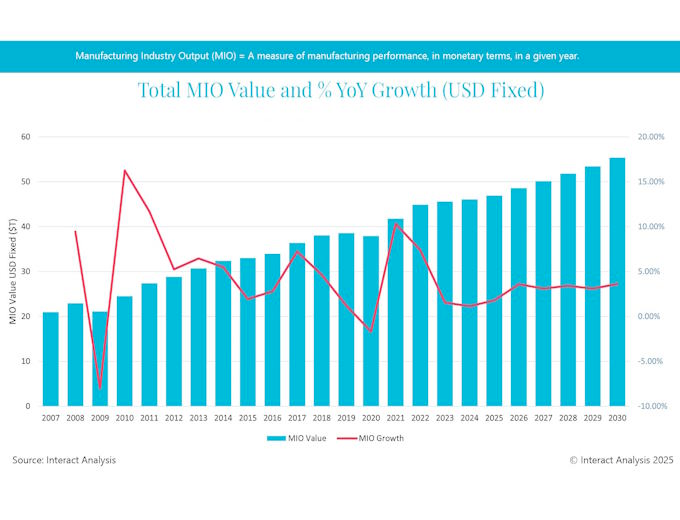

Holiday Trends and 2026 Outlooks: Setting the Economic Tone

As a forward-looking indicator, softer PMIs might foreshadow subdued holiday spending, affecting retail and consumer trends. For 2026, persistent contraction could dampen outlooks, prompting calls for policy adjustments to support manufacturing and tech innovation.

[PDF] S&P Global US Flash PMI - https://www.pmi.spglobal.com/Public/Home/PressRelease/eb6ffb6222214cbfbb42d44541c5ebbe

PMI Commentary and Analysis - S&P Global - https://www.spglobal.com/marketintelligence/en/mi/research-analysis/pmi.html

Week Ahead Economic Preview: Week of 3 November 2025 - https://www.spglobal.com/marketintelligence/en/mi/research-analysis/week-ahead-economic-preview-week-of-3-november-2025.html

PMI, Purchasing Managers' Index – Manufacturing ... - S&P Global - https://www.pmi.spglobal.com/

United States Manufacturing Purchasing Managers Index (PMI) - https://www.investing.com/economic-calendar/united-states-manufacturing-purchasing-managers-index-%28pmi%29-829

S&P Global Services PMI - United States - 2025 Calendar Forecast - https://www.fxstreet.com/economic-calendar/event/5085ec6f-0c90-43d0-83f0-b936a41da1e7

Flash US PMI signals strong start to the fourth quarter | S&P Global - https://www.spglobal.com/marketintelligence/en/mi/research-analysis/flash-us-pmi-signals-strong-start-to-the-fourth-quarter-oct25.html

United States Services PMI - Trading Economics - https://tradingeconomics.com/united-states/services-pmi

[PDF] S&P Global US Manufacturing PMI - https://www.pmi.spglobal.com/Public/Home/PressRelease/366930acdfb446568e98f200e019f63e

US manufacturing mired in weakness as tariff gloom spreads | Reuters - https://www.reuters.com/world/us/us-manufacturing-contracts-further-october-supplier-delivery-times-lengthen-2025-11-03/

US Tariffs: What's the Impact? | J.P. Morgan Global Research - https://www.jpmorgan.com/insights/global-research/current-events/us-tariffs

Short-Run Effects of 2025 Tariffs So Far | The Budget Lab at Yale - https://budgetlab.yale.edu/research/short-run-effects-2025-tariffs-so-far

US manufacturing PMI: five key takeaways as production growth ... - https://www.spglobal.com/marketintelligence/en/mi/research-analysis/us-manufacturing-pmi-five-key-takeaways-as-production-growth-slows-amid-tariff-disruptions-sep25.html

October 2025 ISM ® Manufacturing PMI ® Report - https://www.ismworld.org/supply-management-news-and-reports/reports/ism-pmi-reports/pmi/october/

Tariffs Were Supposed to Revive US Manufacturing. So Far, They're ... - https://www.investopedia.com/tariffs-were-supposed-to-revive-u-s-manufacturing-so-far-they-re-having-the-opposite-effect-11802173

'Not a good sign.' Weak demand continues amid tariff uncertainty: PMI - https://www.manufacturingdive.com/news/pmi-september-2025-tariffs-weak-demand/761560/

2026 Manufacturing Industry Outlook | Deloitte Insights - https://www.deloitte.com/us/en/insights/industry/manufacturing-industrial-products/manufacturing-industry-outlook.html

May 2025 Manufacturing ISM® Report On Business - PR Newswire - https://www.prnewswire.com/news-releases/manufacturing-pmi-at-48-5-may-2025-manufacturing-ism-report-on-business-302470183.html

Trump Tariffs: Tracking the Economic Impact of the Trump Trade War - https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

S&P global U.S. services PMI comes in at 54.8 vs. 55.2 estimated - https://www.youtube.com/watch?v=SxddvGEv5TA