US Economic Data Releases: Anticipation for October Retail Sales and PPI Amid Tariff Concerns

- Marketing Admin

- Nov 13

- 3 min read

The US economy is on the edge as key data releases loom. Tomorrow, November 14, 2025, at 8:30 AM ET, the Bureau of Labor Statistics (BLS) and the US Census Bureau will unveil October's Retail Sales figures and the Producer Price Index (PPI). These indicators, among the week's most awaited, could reveal consumer spending trends and wholesale inflation pressures, especially in the context of President Trump's proposed tariffs ranging from 10% to 60% on imports. Analysts anticipate a modest 0.3% month-over-month rise in Retail Sales, potentially tempered by tariff-induced cost increases for goods like electronics. With market volatility expected, tech stocks and Federal Reserve rate decisions hang in the balance, while discussions on X highlight concerns over GDP drags.

Key Indicators: What to Expect from Retail Sales and PPI

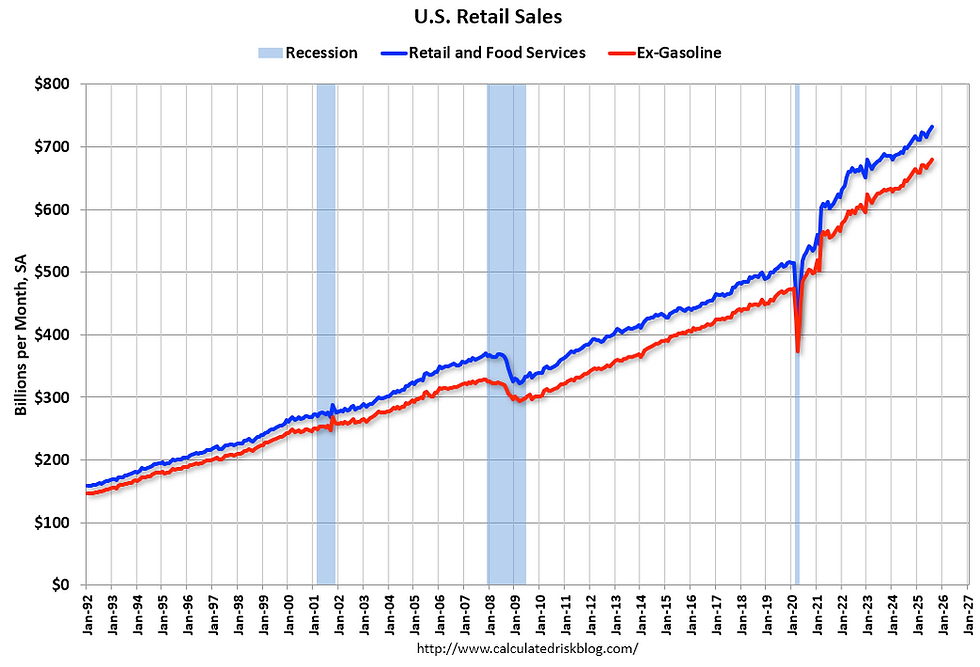

Retail Sales data tracks consumer spending, a cornerstone of US economic growth. For October 2025, expectations point to a 0.3% increase, reflecting cautious optimism amid rising costs. However, recent trends show variability; for instance, August saw a 0.6% rise, but holiday preparations could boost figures. The PPI, measuring changes in selling prices for producers, is forecasted to show core inflation ticking up 0.3% monthly, with annual headline at 2.6%. This data is crucial for gauging inflation at the wholesale level, which often precedes consumer price changes.

Tariffs' Role: Fueling Inflation and Affecting Consumer Behavior

President Trump's tariff proposals, including 10-60% hikes on various imports, are designed to protect domestic industries but carry inflationary risks. These measures could increase the price of imported goods like electronics and apparel, directly impacting Retail Sales by curbing consumer spending. Economists warn that tariffs have already contributed to higher inflation, with projections showing an additional $592 billion in costs to consumers by year's end. In the broader economy, this "turbulence tax" affects supply chains and business investments, potentially dragging GDP growth.

Market Volatility and Fed Implications

Expect heightened volatility post-release. Tech-heavy indices like the Nasdaq may react sharply to inflation signals, as persistent price pressures could influence the Federal Reserve's decisions on interest rates. If PPI exceeds expectations, it might reinforce concerns over fading disinflation, prompting a reevaluation of rate paths.

Affinity Solutions: Retail Monitor shows Continued Momentum - https://www.affinity.solutions/newsroom/cnbc-nrf-retail-monitor-october-data-shows-continued-momentum-going-into-holiday-season/

NRF: CNBC/NRF Retail Monitor's October Data - https://nrf.com/media-center/press-releases/cnbc-nrf-retail-monitor-s-october-data-shows-strong-momentum-going-into-holiday-season

Rapaport: US Retail Sales Rebound in October - https://rapaport.com/news/us-retail-sales-rebound-in-october/

Trading Economics: US Retail Sales - https://tradingeconomics.com/united-states/retail-sales

BLS: Schedule of Selected Releases 2025 - https://www.bls.gov/schedule/2025/home.htm

FRED: Economic Release Calendar - Advance Monthly Sales - https://fred.stlouisfed.org/releases/calendar?od=asc&rid=9&ve=2018-12-31&view=year&vs=2018-01-01

Adobe: U.S. Online Spending Hits $88.7B in Oct 2025 - https://business.adobe.com/blog/adi-october-2025-holiday-shopping-actuals

FXStreet: Retail Sales (MoM) - United States - https://www.fxstreet.com/economic-calendar/event/31b216da-2502-4428-af5b-d3c54b68ebe4

Census Bureau: Monthly Retail Trade - Sales Report - https://www.census.gov/retail/sales.html

Investing.com: United States Producer Price Index (PPI) YoY - https://www.investing.com/economic-calendar/ppi-734

BLS: Producer Price Index Home - https://www.bls.gov/ppi/

FRED: Economic Release Calendar - Producer Price Index - https://fred.stlouisfed.org/releases/calendar?rid=46&ve=2022-12-31&view=year&vs=2022-01-01

Trading Economics: United States Producer Prices Change - https://tradingeconomics.com/united-states/producer-prices-change

Plus500: PPI October 2025: Producer Price Index Report Release - https://www.plus500.com/en/newsandmarketinsights/ppi-october-2025-producer-price-index

CNBC: PPI - https://www.cnbc.com/ppi/

Equals Money: When is the next US PPI report released? - https://equalsmoney.com/economic-calendar/events/us-ppi

FXStreet: Producer Price Index (MoM) - United States - https://www.fxstreet.com/economic-calendar/event/a4ee30f4-d722-45e1-90da-ac20acf9b6c3

RBC: US Week Ahead: Fed's fog thickens with no October inflation data - https://www.rbc.com/en/thought-leadership/economics/featured-insights/us-week-ahead-feds-fog-thickens-with-no-october-inflation-data/

Tax Foundation: Trump Tariffs: Tracking the Economic Impact - https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

Thomson Reuters: Impact of tariffs on tax and trade in 2025 - https://tax.thomsonreuters.com/blog/impact-of-tariffs-on-tax-and-trade/

The Budget Lab: Short-Run Effects of 2025 Tariffs So Far - https://budgetlab.yale.edu/research/short-run-effects-2025-tariffs-so-far

J.P. Morgan: US Tariffs: What's the Impact? - https://www.jpmorgan.com/insights/global-research/current-events/us-tariffs

Inc. Magazine: Tariffs and Inflation Are Threatening Holiday Shopping - https://www.inc.com/chris-morris/tariffs-and-inflation-are-threatening-holiday-shopping/91262476

NBC News: U.S. consumers bearing more than half the cost of tariffs - https://www.nbcnews.com/business/consumer/us-consumers-bearing-half-cost-tariffs-far-goldman-sachs-says-rcna237283

American Progress: 8 Ways Trump's Turbulence Tax Is Costing the Economy - https://www.americanprogress.org/article/8-ways-trumps-turbulence-tax-is-costing-the-economy/

BBC: What tariffs has Trump announced and why? - https://www.bbc.com/news/articles/cn93e12rypgo

Investopedia: Tariffs Have Pushed Up Inflation - https://www.investopedia.com/tariffs-have-pushed-up-inflation-and-there-are-more-price-hikes-to-come-economists-say-11832086

[post:19] X Post by Real BIonde Broker: Upcoming economic data and tariffs - https://x.com/_BIondebroker/status/1954705258569175224

[post:20] X Post by Real Blonde Broker: Vacation and data releases - https://x.com/blondebroker1/status/1954642569331425389

[post:21] X Post by Ron Keebler: Democrats on tariffs and inflation - https://x.com/RonKeebler1/status/1945977200932540759

[post:22] X Post by iAM: USD CPI, PPI, and tariffs - https://x.com/ii_melchizedek/status/1944663577350033565

[post:23] X Post by Citadel: Soft PPI and tariffs - https://x.com/citadel_agent/status/1923077232806797440

[post:24] X Post by Monical: Tariffs, Rates & Retail Surge - https://x.com/Monical216834/status/1912763926888243262

[post:25] X Post by X Options: Recap on tariffs and data - https://x.com/OptionsDavid/status/1891191286352519443

[post:27] X Post by Tom: Last Week Recap on tariffs - https://x.com/TradingThomas3/status/1891170677400752136

[post:28] X Post by Sanjay B Dalal: Welcome 2025 trends - https://x.com/SanjayBDalal/status/1890469371341857269

[post:30] X Post by CuriousCats.ai: U.S. Treasury yields and PPI - https://x.com/CuriousCats_US/status/1890357143490232502