Weekend Economic Recap 2025: Labor Market Slowdown Warnings and Tariff Impacts on 2026 GDP Forecasts Amid Global Slowdown Concerns

- Marketing Admin

- Nov 17

- 4 min read

As November 2025 unfolds, the U.S. economy stands at a critical crossroads, marked by decelerating job growth and escalating tariff threats that are reshaping growth projections for 2026. Weekend analyses highlight October's subdued labor market data—impacted by the ongoing government shutdown—with private estimates showing only 42,000 jobs added, far below the expected 150,000. Tariffs are projected to drag 2026 GDP down to 2.5-2.9%, tying into broader global slowdowns where uncertainty surges despite positive sentiment. Previews of next week's data, including business inventories, underscore potential further weaknesses, particularly in emerging sectors like electric vehicles (EVs) and batteries hit hard by U.S. policies.

Labor Market Warnings: Decelerating Job Growth in October Amid Shutdown Data Gaps

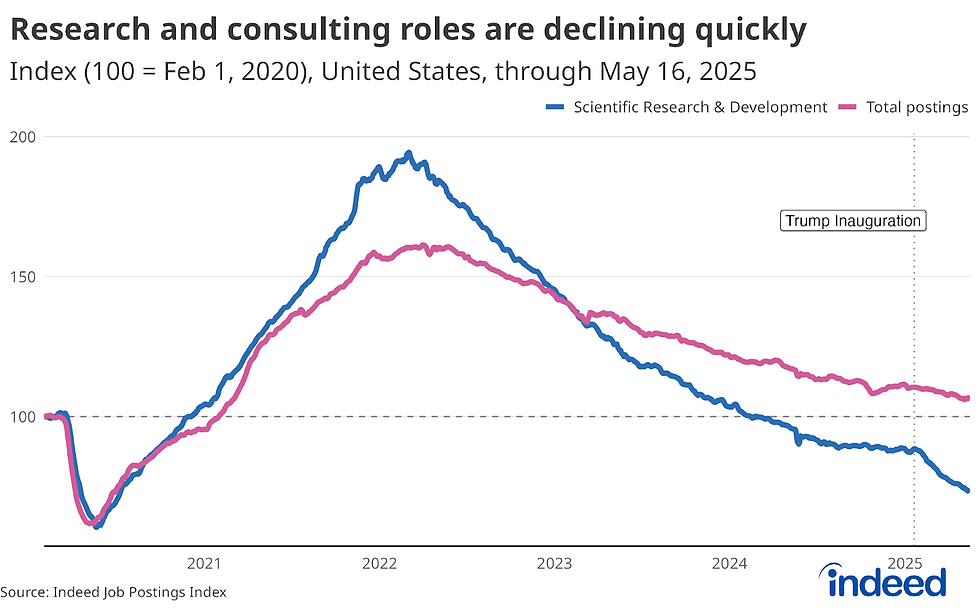

October 2025's labor data paints a picture of slowdown, with nonfarm payrolls hampered by the record-long government shutdown, preventing official Bureau of Labor Statistics (BLS) releases. Private ADP reports indicate only 42,000 jobs added, down from 79,000 in July and 22,000 in August, signaling a cooling market far below the anticipated 150,000. Revelio Labs notes a drop in nonfarm employment, exacerbating concerns over weakening consumer confidence and retail spending. This deceleration ties into broader economic drags, with job postings elevated in just over half of sectors, per Indeed data.

Tariff Threats Weigh on 2026 GDP Forecasts: Down to 2.5-2.9%

Tariff escalations are forecasted to shave 0.4-0.54 percentage points off U.S. GDP in 2026, lowering projections to 2.5-2.9% amid higher inflation and household costs. UBS estimates an additional 0.8 percentage points to core PCE inflation, potentially pushing parts of the economy into recession. The IMF upgraded 2025 growth to 2% but notes tariffs cause less immediate disruption, while Deloitte's downside scenario sees consumer spending growth halving. Per household, tariffs equate to a $1,600 tax increase in 2026, per Tax Foundation.

Previews of Next Week's Data: Business Inventories and More

Looking ahead to the week of November 17, key releases include Business Inventories for September (expected 0.2% MoM) on November 17, alongside New York Fed Staff Nowcast. Other highlights: Initial jobless claims (November 15), Existing home sales (October), U.S. leading indicators (October). Shutdown delays may persist, but economists anticipate these figures to reveal inventory builds amid slowing demand.

Ties to Global Slowdowns: Emerging Sectors Like EVs and Batteries Hit Harder

U.S. policies exacerbate global slowdowns, with PMI data showing expansion but geopolitical headwinds building. Tariffs on Chinese graphite (93.5%) and batteries (rising to 25% in 2025) slow EV investments, potentially reversing price drops and disrupting supply chains. EU-US deals set 15% tariffs on EVs, impacting battery manufacturers amid forecasts of 50% price drops by 2026 absent disruptions.

United States Non Farm Payrolls - Trading Economics - https://tradingeconomics.com/united-states/non-farm-payrolls

U.S. Nonfarm Employment Drops In October 2025 - Seeking Alpha - https://seekingalpha.com/article/4841774-us-nonfarm-employment-drops-october-2025

ADP® Employment Report - https://adpemploymentreport.com/

United States Nonfarm Payrolls - Investing.com - https://www.investing.com/economic-calendar/nonfarm-payrolls-227

No October jobs report because of government shutdown - CNBC - https://www.cnbc.com/2025/11/07/shutdown-means-missed-jobs-report-friday-what-it-probably-would-have-shown.html

NFP October 2025: US Nonfarm Payrolls Report, NFP Preview & News - https://us.plus500.com/en/newsandmarketinsights/nfp-ctober-2025-report

All Employees, Total Nonfarm (PAYEMS) | FRED | St. Louis Fed - https://fred.stlouisfed.org/series/PAYEMS

Nonfarm Payrolls - United States - 2025 Calendar Forecast - FXStreet - https://www.fxstreet.com/economic-calendar/event/9cdf56fd-99e4-4026-aa99-2b6c0ca92811

US Nonfarm Payrolls MoM (Monthly) - United States - YCharts - https://ycharts.com/indicators/us_nonfarm_payrolls_mom

U.S. Economic Calendar - MarketWatch - https://www.marketwatch.com/economy-politics/calendar?gaa_at=eafs&gaa_n=AWEtsqfGOVraretjh8_NYWbyiK241V4bellvqNAYvMR_3FoI94uLNT5kYlEd&gaa_ts=6916143c&gaa_sig=znyauGrKWSVfG3676oV0wSjocMVFRyCDht5QKA87UqjRi3zzlVE1DotJpiBun3BvXvdnUYZXCyP_SyjvJBDrPg%253D%253D

Economic Indicators Calendar | New York Fed - https://www.newyorkfed.org/research/calendars/nationalecon_cal

CPI, jobless claims, and oil inventories highlight Thursday's ... - https://www.investing.com/news/stock-market-news/cpi-jobless-claims-and-oil-inventories-highlight-thursdays-economic-data-93CH-4352560

Economic Calendar - https://tradingeconomics.com/calendar

Economic Indicator Release Schedule: List View - US Census Bureau - https://www.census.gov/economic-indicators/calendar-listview.html

Calendar of Economic Release Dates (November 2025) | Post - https://www.scotiabank.com/ca/en/about/economics/economics-publications/post.other-publications.calendar-of-economic-release-dates.calendar-of-economic-release-dates--november-2025-.html

Economic Release Calendar | FRED | St. Louis Fed - https://fred.stlouisfed.org/releases/calendar

When to expect key economic data after the shutdown ... - USA Today - https://www.usatoday.com/story/money/economy/2025/11/11/government-shutdown-when-to-expect-economic-data/87215481007/

2025 Economic Calendar - https://us.econoday.com/

US Economic Calendar - Briefing.com - https://www.briefing.com/calendars/economic?Filter=All

Trump-era policy shift slows US EV investment plans - https://www.automotivemanufacturingsolutions.com/electrification/trumpera-policy-shift-slows-us-ev-investment-plans/1597967

U.S. Proposes Steep Tariffs on Critical E.V. Battery Material - https://www.nytimes.com/2025/07/17/business/trump-graphite-tariff-electric-vehicles.html

EU-US Trade Deal Sets 15% Tariff: Implications for EV Battery Industry - https://www.batterytechonline.com/battery-manufacturing/eu-us-trade-deal-sets-15-percent-tariff-implications-for-ev-battery-industry

Trump Tariffs: Tracking the Economic Impact of the Trump Trade War - https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

EV Tariffs and Trade Shifts: May 2025 Auto Industry Update - https://www.dickinson-wright.com/news-alerts/an-ev-newsletter-vol-3-no-5

US firms join forces in partnership that could revolutionize EVs - https://finance.yahoo.com/news/us-firms-join-forces-partnership-103000497.html

Live From the 2025 Battery Show: Trump Tariffs Take a Bite Out of ... - https://www.afslaw.com/perspectives/alerts/live-the-2025-battery-show-trump-tariffs-take-bite-out-ev-battery-production

How US tariffs on China will disrupt the EV market - Just Auto - https://www.just-auto.com/analyst-comment/how-us-tariffs-on-china-will-disrupt-the-ev-market/

How Tariffs Affect the Ev Market - LinkedIn - https://www.linkedin.com/top-content/corporate-social-responsibility/electric-vehicle-insights/how-tariffs-affect-the-ev-market/

'The tariffs are a big tax increase': Top bank crunches the ... - Fortune - https://fortune.com/2025/11/12/tariffs-big-tax-increase-decent-chunk-economy-in-recession-ubs/

Trump Tariffs: Tracking the Economic Impact of the Trump Trade War - https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/

US Tariffs: What's the Impact? | J.P. Morgan Global Research - https://www.jpmorgan.com/insights/global-research/current-events/us-tariffs

Economic Forecast for the the US Economy - The Conference Board - https://www.conference-board.org/research/us-forecast

United States Economic Forecast Q3 2025 - Deloitte - https://www.deloitte.com/us/en/insights/topics/economy/us-economic-forecast/united-states-outlook-analysis.html

Outlook 2026 Series | I. The Final Chapter of Trump's Tariffs | Blog - https://en.macromicro.me/blog/outlook-2026-series-i-the-final-chapter-of-trump-s-tariffs

IMF upgrades U.S. economic outlook as tariffs cause less disruption ... - https://www.pbs.org/newshour/nation/imf-upgrades-u-s-economic-outlook-as-tariffs-cause-less-disruption-for-now

'The tariffs are a big tax increase': Top bank crunches the numbers ... - https://finance.yahoo.com/news/tariffs-big-tax-increase-top-223930069.html

Even as Global Uncertainty Surges, Economic Sentiment Remains ... - https://www.imf.org/en/blogs/articles/2025/11/10/even-as-global-uncertainty-surges-economic-sentiment-remains-positive

November 2025 Monthly Outlook: Global Economy Limps With ... - https://www.investing.com/analysis/november-2025-monthly-outlook-global-economy-limps-with-headwinds-building-200669484

Market Sentiment Pivots: From Momentum to Caution in Late 2025 - https://markets.financialcontent.com/wral/article/marketminute-2025-11-13-market-sentiment-pivots-from-momentum-to-caution-in-late-2025

Monthly PMI Bulletin: November 2025 - S&P Global - https://www.spglobal.com/marketintelligence/en/mi/research-analysis/monthly-pmi-bulletin-november-2025.html

World Economic Outlook - All Issues - International Monetary Fund - https://www.imf.org/en/publications/weo

How markets could topple the economy | Nov 15th 2025 - https://www.economist.com/weeklyedition/2025-11-15

Global Weekly Economic Update | Deloitte Insights - https://www.deloitte.com/us/en/insights/topics/economy/global-economic-outlook/weekly-update.html

Oil Market Report - November 2025 – Analysis - IEA - https://www.iea.org/reports/oil-market-report-november-2025

Global Economic Prospects - World Bank - https://www.worldbank.org/en/publication/global-economic-prospects